Protect Your Vehicle With Replacement Cost Insurance

Are you prepared for the unexpected? If your car is declared a total loss, traditional insurance often covers only its depreciated value. But there’s a smarter way to protect your investment: Replacement Cost Car Insurance. Designed to safeguard drivers in British Columbia (BC) and Alberta, this coverage ensures you’re not out of pocket when your vehicle’s value declines. Replacement Cost coverage is especially vital due to the high costs of vehicles and your unique driving risks. Whether you’re considering coverage for a new or used car or exploring options for financed and leased vehicles, this guide will help you understand why replacement insurance is essential.

What Is Replacement Cost Car Insurance?

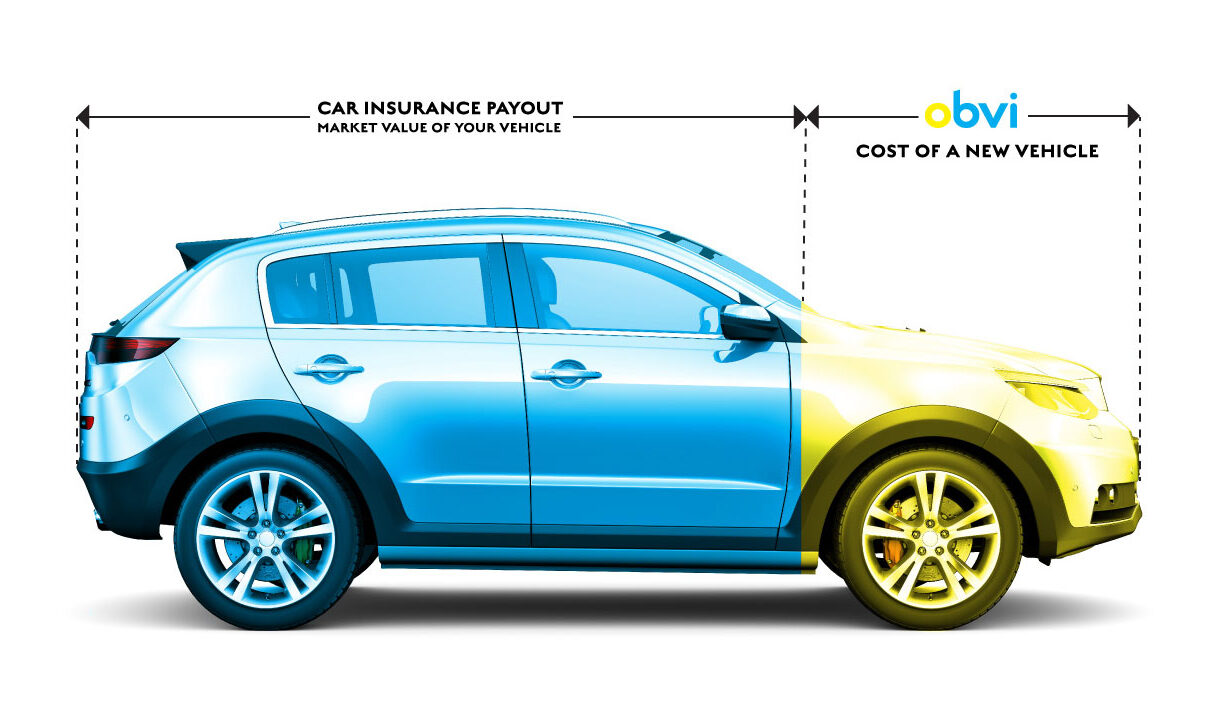

Replacement cost car insurance protects against depreciation, paying out the full replacement value of your vehicle rather than its depreciated cash value. If your car is totalled, this policy bridges the gap between what your primary insurer offers and what it would cost to replace your car with a new or better one.

Key Features of Replacement Cost Insurance:

- It covers the cost of replacing your vehicle with a brand-new mode

- Available for both new and slightly used vehicles.

This makes it an excellent option for new car buyers or those purchasing slightly used vehicles who want peace of mind in case of theft or an accident.

Types of Replacement Coverage Options

Our offerings ensure you’re covered, no matter your needs:

- New Car Replacement Insurance: If your new car is totalled, this policy replaces it with the latest model year. Perfect for recent buyers who want full-value protection.

- Better Car Replacement Insurance: For used car buyers, this policy provides coverage for a vehicle of the same value—or better!—than the one you originally purchased, even after accounting for depreciation.

Why Replacement Cost Insurance Makes Sense

Traditional policies can leave drivers vulnerable. Here’s why upgrading to replacement cost insurance is smart:

- Depreciation Happens Fast: Cars lose an average of 10% of their value annually. This can leave you significantly under-compensated in the event of a total loss.

- Loan Coverage: If you’re financing your car, depreciation might mean your payout doesn’t cover the remaining balance—our Loan Protection Gap Insurance add-on can cover that gap.

- Affordable Peace of Mind: A replacement cost policy provides robust financial protection at a competitive price that you can get for a low monthly payment.

- Locked-in Premiums: Your premium stays the same on a long-term policy and won’t increase because of a claim, change in address, or young drivers.

How Replacement Cost Insurance Works

Here’s a step-by-step breakdown:

- File a Claim: If your vehicle is written off, start by submitting a claim to your primary insurer.

- Receive Depreciated Value: Your insurer will calculate and offer the depreciated value of your vehicle.

- Top-Up Coverage: Replacement insurance steps in to cover the difference, helping you afford a comparable or better car.

For example:

- Without Replacement Cost Car Insurance: You bought your car for $50,000, but your insurer only pays $32,000 after depreciation.

- With Replacement Cost Car Insurance: You are reimbursed the full $50,000, or more if you choose enhanced options. That’s an $18,000 improvement!

How Much Will Your Vehicle Depreciate?

Use this depreciation calculator to see how much your car’s value has decreased and how replacement cost insurance can cover the gap.

Key Considerations for Replacement Cost and Gap Insurance

Is Replacement Insurance Worth It in BC and Alberta?

Absolutely. Whether you’re driving in Alberta or navigating BC roads, replacement insurance protects against unexpected financial losses. It’s particularly valuable if your car is newer or if you’re financing it.

- High Depreciation Rates: Vehicles lose value quickly, leaving you at a financial disadvantage if your car is totalled.

- Increased Car Prices: The cost of new and used cars continues to rise, meaning you might be unable to cover the cost of a replacement.

- Weather Risks: Alberta and BC drivers face unique weather challenges, such as icy winter roads, floods, and hail, increasing the likelihood of a total loss claim.

What About ICBC Replacement Insurance?

While ICBC offers basic auto insurance in British Columbia, ICBC replacement insurance does not typically offer the same level of flexible protection. Your vehicle can’t be more than 2 model years old, and costs can be significantly higher. They may not include better car upgrades, loan GAP protection or flexible policy terms. Also, coverage periods are shorter, typically up to 3 years, and coverage is void if you move out of province.

ICBC offers basic replacement insurance options for drivers in BC, but these often have limitations. Private providers often offer better value, with higher payouts and flexible coverage options. Compare your options carefully to ensure you get the best deal for your situation.

What’s the Difference Between Gap Insurance and Replacement Insurance?

Loan Protection Gap Insurance covers the difference between your remaining car loan balance (the “gap”) and the depreciated settlement paid from your primary insurance provider. Gap insurance won’t cover the additional funds needed for a new car. In contrast, replacement insurance provides the funds needed to replace your vehicle with a new one, making it a more comprehensive solution. If you want full peace of mind, it’s a good idea to consider both types of coverage.

Is a Guaranteed Replacement Cost Endorsement the Same?

A replacement cost endorsement is not the same. A guaranteed replacement cost endorsement is only available on brand-new vehicles through your primary insurer. Coverage can increase in cost significantly year after year. Your primary insurer can also end it after several minor claims or not renew it for many reasons. If you switch insurers to save premiums, you lose the coverage.

In comparison, replacement cost insurance is valid for a fixed term of up to seven years. The premium is one price for the entire term, and it can be bought for new or used vehicles.

Why Choose Obvi for Replacement Cost Coverage?

Our policies stand out by offering:

- Total loss protection: Coverage for up to $60,000 in depreciation loss.

- Flexible Options: Choose from new or better car replacement plans tailored to your budget and needs.

- Affordable payments: Financing through your credit card or bank account for up to 60 months of low payments.

- Add-On Benefits: Enjoy extras like key fob protection, deductible reimbursement, and rental car coverage.

Other coverage benefits

Beyond simply covering the difference of depreciation, a New Car Replacement Cost Insurance policy in BC or Alberta with Obvi can also include several other different perks:

Loan Protection: In the event of a total loss, Loan GAP Protection helps minimize the financial impact when there is a remaining loan balance after the vehicle settlements from the primary insurer and your replacement insurance have been applied. This add-on will pay any remaining loan balance, up to 25% of the vehicle’s replacement value or $30,000, whichever is less.

OEM Parts: Your existing primary insurance policy will pay to repair your vehicle after a partial loss with the cheapest available parts. These could be recycled parts from a scrap yard or aftermarket parts of lesser quality. OEM Parts pays the difference between the cost to repair with scrap yard or aftermarket parts and the repair cost with brand-new OEM parts from the vehicle manufacturer. Coverage is available until model year 5, $2,500 per year, maximum $10,000 per policy.

Partial-Loss Deductible Reimbursement: If you have to pay a partial-loss deductible during the policy term for things like glass or a minor collision, the policy will reimburse your deductible up to $500. You have unlimited use throughout the policy term.

Rental Vehicle Reimbursement: If loss of use rental coverage is exhausted under your primary insurance policy due to a delay in repairs or replacement of the vehicle, the policy will reimburse the additional cost of a rental vehicle up to $50 per day to a maximum of $2,500 per year.

Lost or Stolen Key Fob Protection: If you lose your key fob during the policy term, the policy will pay to replace it. Coverage is one-time use per policy, up to $500.

Get a Free Quote Today

Protect your investment with the best replacement cost insurance in BC and Alberta. Click below to request a free, no-obligation quote today and enjoy peace of mind on every drive.